Hong Kong is host to the world’s busiest venue for initial public offerings this year. And the worst losses in a decade.

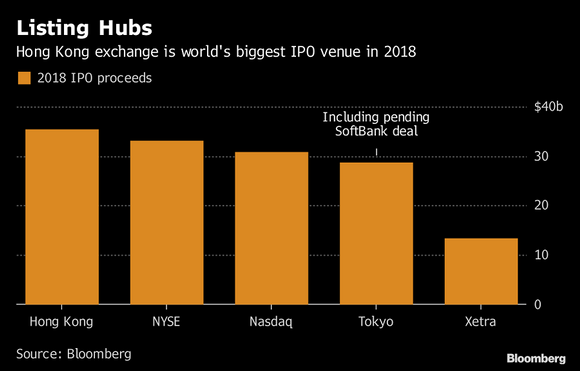

A boom in technology listings has propelled local deal value to $35.7 billion, ahead of the New York Stock Exchange, according to data compiled by Bloomberg. Yet companies that raised at least $100 million dropped 6.2 percent in their first month of trading on average, the worst return since 2008. Weighted by IPO size, losses reached a record 6.9 percent, according to data going back to 1994.

“A sharp pickup in IPOs may signal a sector’s downcycle ahead,” said Liang Jinxin, a strategist at Tianfeng Securities Co. “Technology companies fear an industry downturn will get worse if they don’t go public now.”

New-economy firms — including tech, Internet and biotech companies — accounted for more than 40 percent of Hong Kong’s proceeds this year, up from about 20 percent in 2017.

They’ve also been some of those that suffered the most, with tech shares on the MSCI Hong Kong Index sinking more than any other industry group as giant Tencent Holdings Ltd. heads for its worst year on record.

Ping An Healthcare and Technology Co., listed in May, and Ascletis Pharma Inc., which began trading in August, have plunged 43 percent and 57 percent, respectively, from their offer prices, ranking among the worst-performing new stocks this year. In Ping An Healthcare’s offering, zealous retail investors placed orders for 654 times the shares initially available to them.

Hong Kong’s listing reform to attract technology companies helped boost IPO supply, but the demand remained slack amid macro weakness, said Philippe Espinasse, the author of “IPO: A Global Guide” and former head of Asia’s equity capital markets group at Nomura Holdings Inc.

In July, smartphone maker Xiaomi Corp. sold shares in Hong Kong for a valuation of about $50 billion, a far cry from top executives’ target of $100 billion last year. Food-delivery giant Meituan Dianping, which aimed for a minimum market value of $60 billion, settled for about $50 billion in its September listing. E-commerce platform Mogu Inc. slashed its valuation goal by more than half for a U.S. debut this month.

“Few IPOs have exhibited cornerstone demand, while levels of over-subscription, both for institutions and members of the public, have frequently been on the low side,” Espinasse said.

For firms that raised more than $100 million in Hong Kong this year, individual investors placed orders for a median 1.6 times the stock available to them, down from 2.4 times in 2017, data compiled by Bloomberg show. Despite sluggish demand, Chinese companies decided to go ahead with their listings to bolster their war chests as the U.S. increased interest rates and fought with China on trade, Espinasse said.

First-time share sales have raised $33.1 billion on the NYSE and $30.8 billion on the Nasdaq this year, data compiled by Bloomberg show. Hong Kong would rank No. 2 among countries if the two American exchanges were combined for U.S. proceeds.