Singapore capital market will continue to attract listings from niche sectors such as REITs & BTs, healthcare and F&B in 2019 given the pro-business environment in the city-state, according to a PwC report.

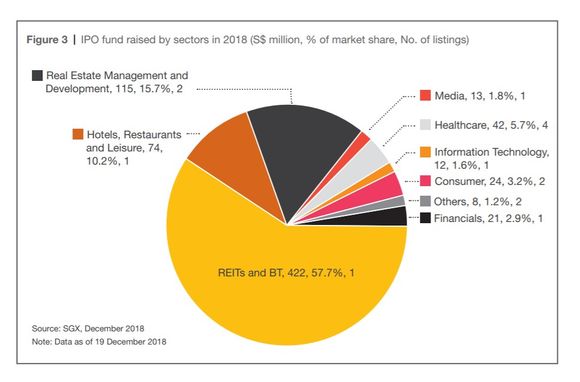

In 2018, real estate investment trusts (Reits), and business trusts (BTs) led the IPO pack on the Singapore exchange accounting for 57.7 per cent in value of all offerings. However, all the S$422 million ($312 million) raised came from a single offering, Mainboard-listed Sasseur Reit – an outlet mall Reit.

As of 19 December 2018, there were a total of 48 REITs and business trusts listed in Singapore with a combined market capitalisation of S$91.7 billion.

Over 75% of these property trusts invest in assets outside of the city-state, pointing to Singapore as an attractive listing destination for overseas real estate players, the report adds.

“The IPO pipeline remains optimistic in 2019 given Singapore’s pro-business environment. SGX has in recent years also stepped up efforts to lure a greater number of IPOs. We can look forward to more fund raising activities in niche sectors such as REITs and BTs, healthcare and F&B sectors,” said Tham Tuck Seng, Capital Markets Leader, PwC Singapore.

PwC also projected that the food and beverage (F&B) sector would emerge as a key sector for equity out-performance in 2019 due to Singapore’s growing population size and increased usage of online food ordering and delivery services.

Other sectors to watch include the technology sector where SGX is teaming up with foreign exchanges like Israel’s Tel-Aviv Stock Exchange (TASE) to allow technology and healthcare companies to list and raise money on both markets simultaneously.

PWC is also expecting the delisting trend to continue due to the ongoing restructuring initiatives by the parent company to streamline group operations.

The report also noted that SGX continues to face competition from Asian bourses such as the Hong Kong Stock Exchange (HKEx) which bagged 207 newly-listed companies in 2018, approximately 19 per cent more than 2017 when it saw the listing of 174 companies.

HKEx has been aggressively liberalising its market regulations including the loosening of capital requirements for internet, high-tech and biomedical R&D industries, and introducing a listing regime for weighted voting rights on 30 April 2018, similar to the Dual Class Share (DCS) structure SGX has implemented for companies seeking listing from 26 June 2018.

An IPO drought in 2018

Towards the end of 2018, SGX recorded a total of 15 IPOs comprising of three listings on the Mainboard and 12 on the Catalist Board, raising a total of S$0.73 billion ($0.54 billion), marking the lowest capital raised since 2015.

Global IPO issuances declined to 870 for year-to-date (YTD) on 30 September 2018 from a total of 1,081 in the same period in 2017, due to challenging market conditions exacerbated by escalating trade war between US and China, rising interest rates and continued tightening of monetary conditions.

Despite the sluggish market conditions, total proceeds raised had increased to $160.6 billion for YTD 30 September 2018 from $141.4 billion in the same period in 2017. The higher IPO proceeds were attributed to robust IPO activities in both the Americas and Hong Kong.