Huawei Supplier SMICs Shares Surge In Hong Kong After NYSE Delisting

A major Chinese chipmaker surged in Hong Kong amid prospects that its decision to stop trading in New York will attract more volume to its main listing.

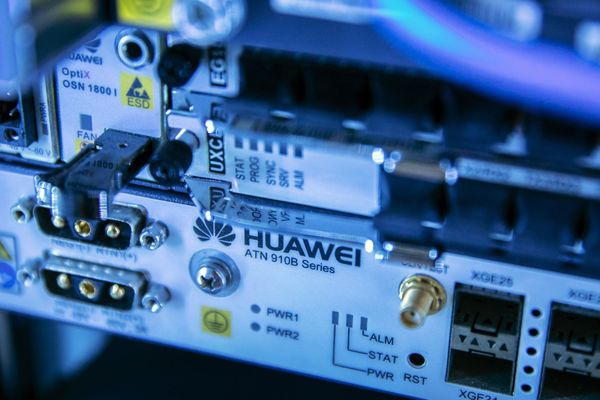

Semiconductor Manufacturing International Corp. was Monday’s top gainer on the MSCI China Index as well as its Asia-Pacific gauge with a 10% rally. It was a different story for its American depositary shares, which tumbled 5.6% at the end of last week in New York after the Shanghai-based firm said it was delisting due to considerations including limited trading volume and costs. SMIC’s biggest customer is the parent of Huawei Technologies Co., the high-profile subject of a U.S. ban.

“The rise in the shares today is mainly due to expectations that U.S. trades in the stock will be funneled over to the Hong Kong-listed company, meaning more demand for the Hong Kong-listed stock,” Csc International Holdings Ltd. analyst Zhu Jixiang said. The decision could also be linked to the escalation in Sino-U.S. trade tension, he said.

“SMIC is one of the top foundries, and right now semiconductors are a sensitive area,” Zhu said. “The company executives might be retreating to save themselves potential worries in the future — after all, being listed in the U.S. means they are subject to securities regulation and frequent executive travel to the U.S.”

SMIC didn’t respond to calls for comment. On Friday, CNBC cited a spokesperson as saying the company had long been considering a delisting and that the decision wasn’t connected to the trade dispute or U.S. ban on Huawei. Delisting requires a lot of preparation and the timing has coincided with the trade rhetoric, the person was quoted as saying.

Data compiled by Bloomberg show that SMIC gets about 18% of its revenue from Huawei, whose billionaire founder told Bloomberg Television that the company will ramp up its own chip supply or find alternatives because of U.S. sanctions.

In a note published Sunday, China International Capital Corp. said the Huawei ban might prompt Beijing to lend more support to the domestic semiconductor industry and that trade friction is a good opportunity for homegrown products to replace imports. SMIC’s 10% rally was its biggest daily gain since Nov. 2, while fellow Hong Kong-listed company Hua Hong Semiconductor Ltd. rose 5.9%.

Bloomberg

Indian Food Delivery Unicorn Zomato Likely To File For IPO Next Month

Food delivery unicorn Zomato is planning to file for an Initial Public Offering (IPO) by April which could raise $65... Read more

Vietnams Bamboo Airways Aims Third-quarter Listing With Market Cap Of $2.73b

Vietnam’s startup Bamboo Airways said on Friday it aimed to list its shares on a local stock exchange in the thi... Read more

Didi Chuxing Advances IPO Plans To Next Quarter, Targets $62b Valuation

Chinese ride-hailing giant Didi Chuxing Technology Co. is accelerating plans for an initial public offering to as early... Read more

Warburg-backed Kalyan Jewellers IPO Loses Shine, Sees Tepid Demand

Kalyan Jewellers India Ltd’s initial public offering was oversubscribed by just 1.28 times on Thursday, a sign of tep... Read more

Chinese E-commerce Platform DMall Hires Banks For Over $500m US IPO

Chinese e-commerce platform Dmall (Beijing) E-commerce Co has hired Bank of America, Goldman Sachs and JPMorgan for a... Read more

Tencent-backed Chinese Software Firm Tuya Eyes $915m In US IPO

Tuya Inc., a software company backed by New Enterprise Associates and Tencent Holdings Ltd., is on track to raise $915 ... Read more