Grand Venture Technology (GVT) Limited, a technology solutions and service provider founded by veteran entrepreneur Lee Tiam Nam (Ricky Lee), has filed a final prospectus to be listed on the Singapore Exchange (SGX) Catalist Board.

The company is seeking to raise gross proceeds of S$13.2 million ($9.74 million) by way of a public offer of 800,000 shares priced at S$0.275 and 42.118 million placement shares.

Sunshine Power will pick up 5.095 million shares in GVT as a cornerstone investor.

GVT offers manufacturing solutions and services for the semiconductor, analytical life sciences, electronics and other industries. It currently operates in Singapore, Malaysia and China.

The company is looking to expand into medical diagnostics and surgical robots development. GVT intends to expand its market reach, technological know-how and operational capabilities via mergers and acquisitions, joint ventures, and partnerships.

It recently entered into a 10-year agreement with Austrian company SICO Technology GmbH and its Singapore outfit, Sico Asia Quartz Pte Ltd, to build its quartz and ceramic machining capabilities.

Ricky Lee currently holds a 43.6 per cent stake in the company through investment holding company Metalbank. Other Metalbank shareholders include Ng Wai Yuen Julian (11.6 per cent); Tan Chun Siong (11.6 per cent); Kong Sang Wah (11.6 per cent); Saw Yip Hooi (11.6 per cent); Ng Kok Chai (4.1 per cent), Loh Kien Giap (4.1 per cent), and Chan Kok Keong (1.7 per cent).

The IPO sponsor and issue manager is CIMB Bank Berhad (Singapore Branch). The underwriter and placement agent is CGS-CIMB Securities (Singapore) Pte Ltd.

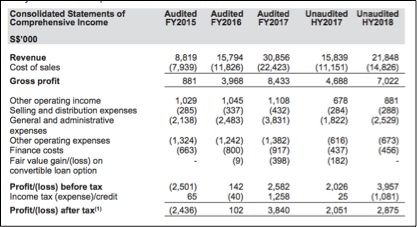

Financial performance of GVT

GVT achieved a two-fold increase in its audited revenue during the financial year ended December 31, 2017 to S$30.86 million, while profit after tax (PAT) rose 37.6 times to S$3.84 million. For the half-year period ended June 30, 2018, revenues rose 37.9 per cent to S$21.85 million, and PAT rose 40.2 per cent to S$2.88 million.

The company currently has cash and cash equivalents balance of S$4.55 million, and net cash from operating activities stood at S$2.39 million as of June 30, 2018. The company’s short, and long-term borrowings amounted to S$8.78 million and S$8.54 million respectively.

The IPO offer opens January 15, 2019 and closes 12 noon SGT on January 21, 2019. The stock will start trading on the SGX Catalist Board on January 23, 2019.

Another IPO for Lee

A semiconductor industry veteran, Lee was one of the founders and executive directors of Norelco Centreline Holdings, a designer and manufacturer of precision machining components that was listed on the SGX in 2001. Norelco is now part of UMS Holdings Limited, which is listed on the SGX Mainboard.

In 2007, Lee joined Eng Tic Lee Achieve Pte Ltd which was subsequently listed on the SGX Mainboard. However, it was delisted in 2009 following an acquisition by Electrotech Investments Limited, now known as Frencken Group. Eng Tic Lee specialised in contract equipment manufacturer, sheet metal manufacturing and precision machining services.