Barely a year after Hong Kong amended its market rules to attract initial public offerings, China’s technology giants are pushing for more.

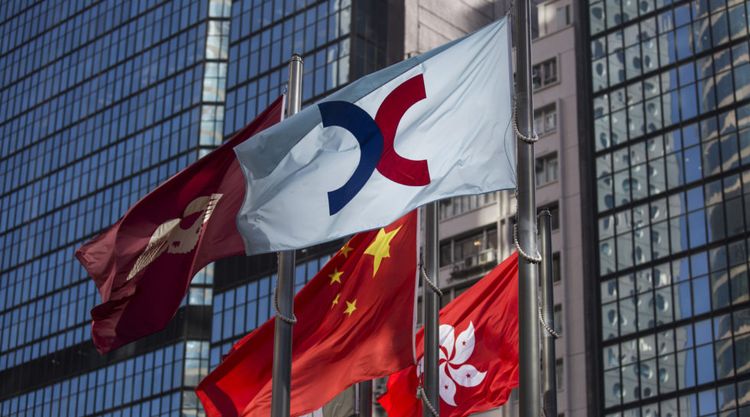

From allowing companies to hold super-voting rights to letting key shareholders buy stock in IPOs, tech companies are lobbying Hong Kong Exchanges & Clearing Ltd. for changes or waivers that would help their businesses, according to people familiar with the matter.

With intense competition from exchanges in New York and elsewhere to win listings, and many multibillion-dollar Chinese companies poised to go public, pressure is building on Hong Kong to maintain its position as a financial center. That’s sparking concern among some investors as the city’s bourse weighs how to balance the interests of shareholders against the goal of being the preeminent IPO destination.

In one instance, Maoyan Entertainment threatened to walk away from Hong Kong if it couldn’t get permission for investor Tencent Holdings Ltd. to buy more shares in its IPO, said the people familiar with the matter, who asked to not be identified as they weren’t authorized to speak on the matter. That was rebuffed by the exchange’s listing committee, the people said.

Allowing Tencent to buy extra stock, a practice known as double-dipping, could have boosted demand for shares in the online movie ticketing platform. Instead, Maoyan priced its IPO at the bottom of its marketed range, and the stock has fallen 6.4 percent since its Feb. 4 debut.

Tencent’s stake in hundreds of companies with the potential for future listings was used by Maoyan in its lobbying effort, a person familiar with the matter said. It also talked up the size of its planned IPO, which at the time was targeting more than $500 million in a declining market, as another reason to allow the waiver, the person said.

Maoyan isn’t alone. Wuxi AppTec Co., a contract medical researcher, also sought permission for double-dipping from Hillhouse Capital, but was rejected, people familiar said. An external representative for Wuxi AppTec declined to comment. Josh Gartner, a spokesman for Hillhouse, didn’t immediately respond to a request for comment.

“The Hong Kong exchange has been cautious, and tries to strike a balance between retail and institutional investors,” said Edward Au, co-leader of the national public offering group at Deloitte China.

HKEX has particularly felt the pressure for change in recent years. In 2014 it missed out on the world’s biggest IPO when Chinese e-commerce titan Alibaba Group Holding Ltd. opted for New York, triggering a re-think on the issue of weighted voting rights.

Last year, smartphone maker Xiaomi Corp. became the first China-based company to IPO in Hong Kong under new rules that allowed dual-class shares after the city had spent decades resisting any change to its “one share, one vote” policy. But Hong Kong’s rules restrict the super-voting stock to individuals, with that extra power expiring when a person leaves the company or dies.

Tencent and Alibaba have lobbied the bourse to change the rules so that companies can have the extra voting power, according to people familiar with the matter. The tech giants have dozens of units and investments they could list with a dual-class share structure, allowing them to maintain control in perpetuity.

While the exchange has so far resisted allowing companies to hold the special class of stock, its language around the issue has softened.

In December 2017, HKEX said it agreed with industry feedback that special shares shouldn’t exist indefinitely. Two months later, and after receiving further feedback “from a number of parties,” it said corporate weighted voting right beneficiaries “would be a significant new development.” HKEX later suggested a yet-to-be-held consultation on the idea.

Tencent Music Entertainment Group, a $26 billion spinoff from the WeChat owner, opted for a U.S. IPO in part because of Hong Kong’s ban on super-voting stock for companies, according to a person familiar with the decision.

When Shanghai Yiguo E-commerce Co Ltd., a fresh food e-commerce site, flirted with the idea of listing last year, it told HKEX that key investor Alibaba wanted to hold weighted voting rights, one of the people said.

Maoyan declined to comment in an emailed statement. HKEX spokeswoman Tori Cowley said the firm does not comment on specific companies. Jane Yip, a spokeswoman for Tencent, didn’t respond to requests for comment. Alibaba and Yiguo declined to comment.

While companies have incentives to push for new rules, any shift in their direction could weaken shareholder rights, said David Smith, the Asia head of corporate governance at Aberdeen Standard Investments in Singapore. “Investors have double risk with corporate weighted voting rights. The risk of the entity that you invest in and the risk of the firm that holds the weighted shares,” he said.

Part of the exchange’s challenge is that companies can play Hong Kong off against other jurisdictions with different rules. An IPO on Nasdaq Inc.’s stock exchange doesn’t require a waiver for double-dipping as long as there are no favorable terms of allocation or pricing are given, said Stephen Peepels, a capital markets lawyer at Hogan Lovells in Hong Kong. What’s required is full disclosure so investors have adequate information, he said.

As Hong Kong considers lobbying efforts, it will have to keep weighing the interests of retail shareholders that represent a significant chunk of trading. Deloitte’s Au estimates that individuals account for 25 percent of trades compared with about 5 percent in the U.S.

“The Hong Kong stock exchange is more cautious than its U.S. counterparts because the retail investor base here is much larger,” Au said.

Bloomberg